Everyone has a money story, whether they realize it or not. It’s the quiet script running in the background of your financial decisions—the beliefs you inherited, the habits you picked up, the fears you’ve never questioned, and the goals you’re still figuring out. Most of us don’t stop to ask where that script came from or whether it still fits the life we want. But here’s the thing: if you don’t rewrite your money story, it will happily keep writing itself. And the plot twists it creates aren’t always the ones you’d choose. The good news? You have far more creative control than you think.

Recognizing the Script You Started With

Before you can rewrite your money story, you need to understand the one you already have. It often starts in childhood—what you saw your family do, what you heard them say, how money felt in your home. Maybe it felt scarce, maybe it felt stressful, or maybe it felt like something you just weren’t supposed to talk about. These early messages become assumptions you carry into adulthood. Recognizing your starting script helps you see which parts you want to keep and which parts are overdue for revision.

Challenging the “I’m Just Not Good With Money” Myth

One of the most common storylines people get stuck in is the belief that they’re simply not good with money. It becomes a character trait instead of a learned skill. But the truth is, no one is born knowing how to budget, save, invest, or plan. These are skills you build over time, not traits you inherit. Once you challenge the myth, you open space for a new narrative—one where you’re capable, improving, and allowed to make mistakes as you learn. Changing this belief alone can reshape an entire money story.

Identifying Your Patterned Plot Twists

Everyone has recurring financial patterns: the impulse splurges, the months where everything falls apart, the moments when you avoid checking your account because you already know the answer. These patterns feel like plot twists, but they’re often predictable once you start paying attention. When you identify them, you can finally shift from reacting to anticipating. Patterns don’t have to define you; they’re just clues pointing to what needs attention, support, or a different approach.

Introducing New Characters: Your Future Goals

A compelling story always has a vision for where the characters are headed, and your financial life is no different. When you don’t clarify your goals, money tends to drift wherever your habits take it. Bringing your future self into the picture adds direction and purpose. Maybe it’s a future where you travel more, work less, own a home, build a business, or simply feel less stressed when bills roll in. These goals become the new characters shaping your plot, influencing your choices in the present.

Rewriting Through Small, Consistent Actions

Changing your money story isn’t about grand gestures or dramatic overnight transformations. It’s about small actions building up over time. Tiny shifts—like checking your accounts weekly, setting up an automatic transfer, or planning your spending before the month begins—can completely change the narrative. Consistency becomes the new plot device, slowly rewriting the storyline in your favor. Over time, these small actions create big changes in confidence, clarity, and control.

Your financial story isn’t something that happens to you; it’s something you have the power to shape, edit, and transform. You don’t need permission to rewrite it, and you don’t have to wait for a financial crisis to start. When you take ownership of your narrative, you shift from being the character reacting to the plot to becoming the author directing it. And once you start writing intentionally, your money story becomes less about survival and more about possibility.…

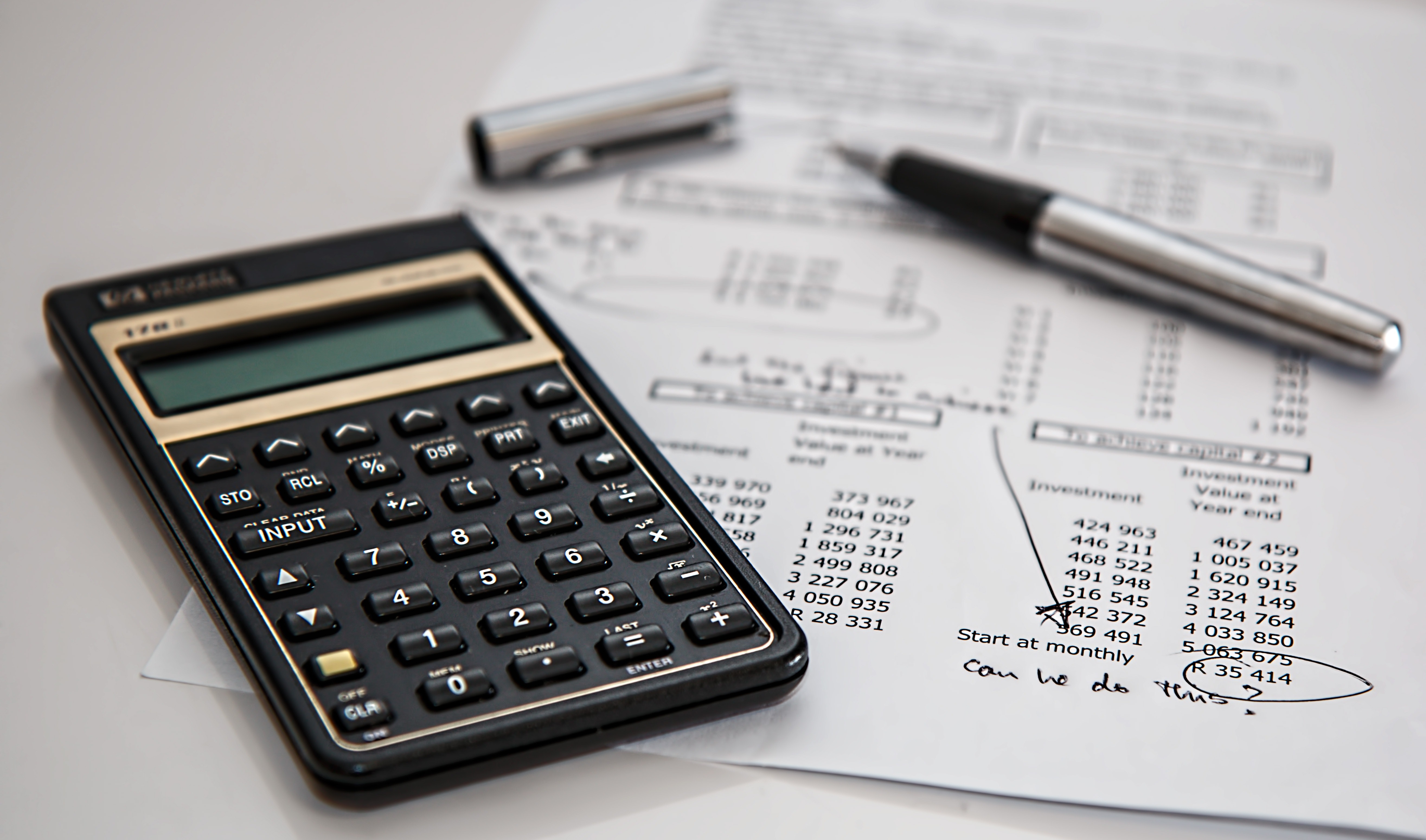

Finally, if you have some extra cash lying around and want to get serious about increasing your monthly income, consider investing. You can make all sorts of investments that can offer tremendous returns and put more money in your pocket every month. Of course, it’s more than the icing on the cake to do your research first and understand the risks involved with any investment before committing to it. But if done responsibly and wisely, an investment could be a great way to boost your monthly savings.

Finally, if you have some extra cash lying around and want to get serious about increasing your monthly income, consider investing. You can make all sorts of investments that can offer tremendous returns and put more money in your pocket every month. Of course, it’s more than the icing on the cake to do your research first and understand the risks involved with any investment before committing to it. But if done responsibly and wisely, an investment could be a great way to boost your monthly savings.

There are many advantages to hiring a credit repair company. One of the most important is that they can help you remove items from your report that may be affecting your scores, such as late payments or other derogatory marks on your account. They will also ensure all information reported about you is accurate and up-to-date.

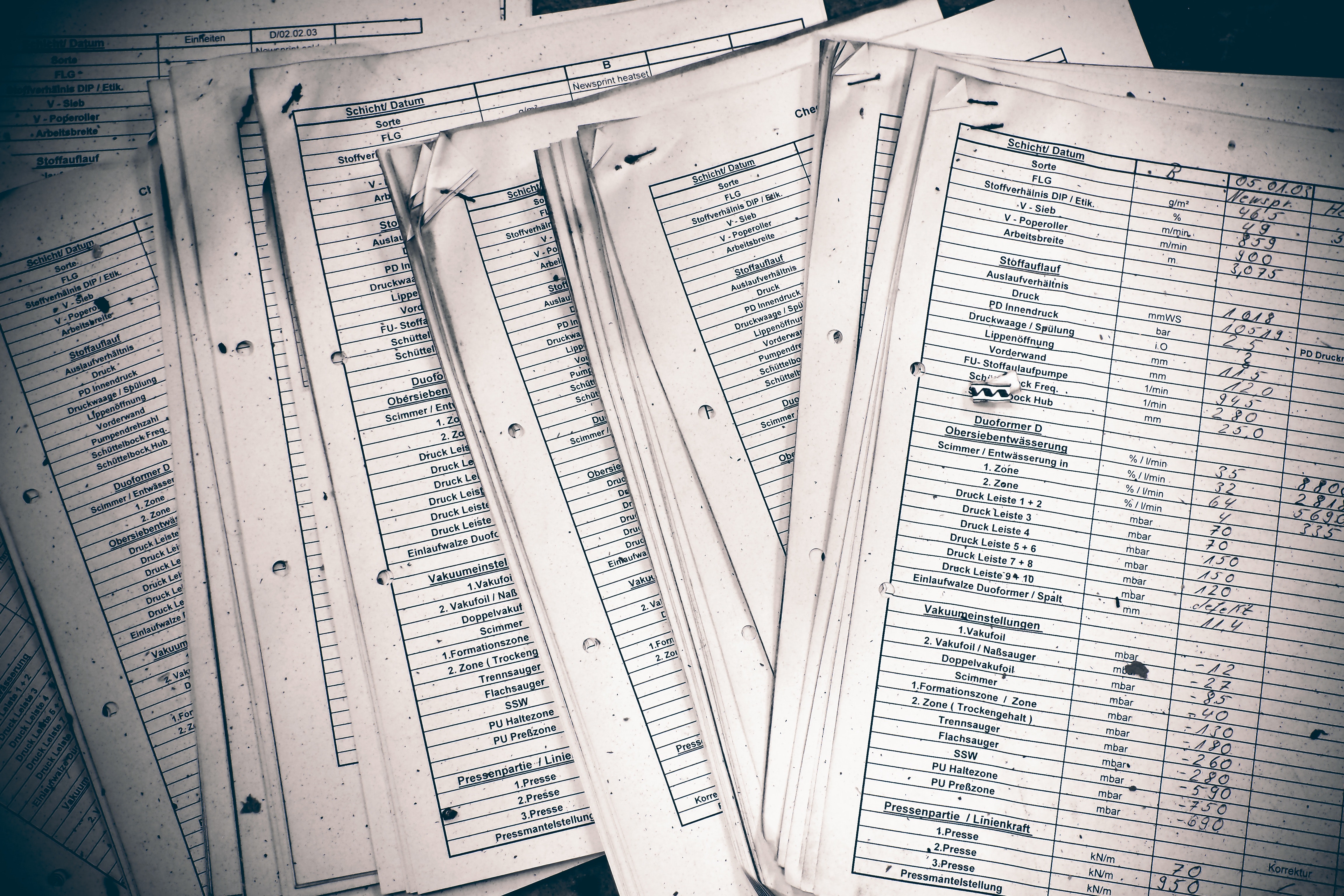

There are many advantages to hiring a credit repair company. One of the most important is that they can help you remove items from your report that may be affecting your scores, such as late payments or other derogatory marks on your account. They will also ensure all information reported about you is accurate and up-to-date. There are also some disadvantages to hiring a credit repair company. For starters, these businesses typically charge a fee for their services, so it can be expensive if you have a lot of work done. Additionally, not all companies are reputable, and some will make promises they cannot keep. This could leave you with a bad credit score and no one to turn to for help if something goes wrong. While there are many advantages of hiring such companies, it is important to realize they will cost you money in the form of fees for their services. You must ask for hidden fees, read the fine print and understand all terms before signing any contract.

There are also some disadvantages to hiring a credit repair company. For starters, these businesses typically charge a fee for their services, so it can be expensive if you have a lot of work done. Additionally, not all companies are reputable, and some will make promises they cannot keep. This could leave you with a bad credit score and no one to turn to for help if something goes wrong. While there are many advantages of hiring such companies, it is important to realize they will cost you money in the form of fees for their services. You must ask for hidden fees, read the fine print and understand all terms before signing any contract.

When handling financial tasks in your business, you need to track and monitor payrolls, expenses, investments, and profits. Besides, you also need to accomplish some financial tasks. It’s not ideal to hire accountants that focus on specific tasks as you might need their skills to perform other accounting roles like filing business taxes.

When handling financial tasks in your business, you need to track and monitor payrolls, expenses, investments, and profits. Besides, you also need to accomplish some financial tasks. It’s not ideal to hire accountants that focus on specific tasks as you might need their skills to perform other accounting roles like filing business taxes.

Among the key things that determine your credit score is your payment history. You stand to get an excellent credit score if you have a long history of meeting your obligations on time, especially loans. And to enjoy this benefit, ensure you are not late in paying your loans or credit card balances by more than 29 days. This is because lenders can share with credit reference bureaus payments that are at least 30 days late, which can negatively impact your credit score.

Among the key things that determine your credit score is your payment history. You stand to get an excellent credit score if you have a long history of meeting your obligations on time, especially loans. And to enjoy this benefit, ensure you are not late in paying your loans or credit card balances by more than 29 days. This is because lenders can share with credit reference bureaus payments that are at least 30 days late, which can negatively impact your credit score. You need to request your credit report and comb through it to check for any mistakes, e.g., errors in personal details like names, addresses, or wrong entries or omitted entries. Because all those things can affect your score, you need to launch complaints about them so the credit bureau can correct them. If you also find any payment you have been paying not included in the report, report that so they can add it because it can boost your score.

You need to request your credit report and comb through it to check for any mistakes, e.g., errors in personal details like names, addresses, or wrong entries or omitted entries. Because all those things can affect your score, you need to launch complaints about them so the credit bureau can correct them. If you also find any payment you have been paying not included in the report, report that so they can add it because it can boost your score. Sometimes you may think closing a credit card account is a good idea to avoid piling up debts. However, if you are looking to improve your score, it can hurt your score. This happens for two main reasons: firstly, you lose that credit card’s history that was contributing to your score. Secondly, you reduce your credit limit when the overall credit utilization is computed, resulting in a lower score. So, do not close any credit card accounts when working on building your credit rating.…

Sometimes you may think closing a credit card account is a good idea to avoid piling up debts. However, if you are looking to improve your score, it can hurt your score. This happens for two main reasons: firstly, you lose that credit card’s history that was contributing to your score. Secondly, you reduce your credit limit when the overall credit utilization is computed, resulting in a lower score. So, do not close any credit card accounts when working on building your credit rating.…

Choosing the person who is going to treat you may not seem like a big deal. But you may have that thought because you do not have any pressing medical needs. People who suffer from a terminal disease may need multiple surgeries to survive. And in their case, comforts, interpersonal intimacy, and the personality of the doctors matter significantly to them.

Choosing the person who is going to treat you may not seem like a big deal. But you may have that thought because you do not have any pressing medical needs. People who suffer from a terminal disease may need multiple surgeries to survive. And in their case, comforts, interpersonal intimacy, and the personality of the doctors matter significantly to them.

Besides mastering a couple of trading strategies, you also need to know what is happening in the market. The forex markets tend to be quite dynamic, and a small incidence might have a significant ripple effect of the currency pairs. Make an effort of following UK Forex News and market coverage from other reputable forex websites.

Besides mastering a couple of trading strategies, you also need to know what is happening in the market. The forex markets tend to be quite dynamic, and a small incidence might have a significant ripple effect of the currency pairs. Make an effort of following UK Forex News and market coverage from other reputable forex websites.